Axi is a forex and CFD trader with a purpose of striving to give its traders and partners the edge they need for success. Founded as AxiTrader in Australia in 2007, its headquarters is in Sydney while it has offices in London, Kingston, Dubai, China, Germany and South Africa. Axi boasts of offering more than 130 tradable assets to over 60,000 traders that come from over 100 countries.

Axi affirms that with its high performance technology, clients are offered raw spreads, flexible leverage and lightning speed trade executions. A myriad of trading tools are provided to support all traders regardless of strategy, experience or trading volume.

Axi is proud to partner the English Football team ‘Manchester City’ stating that both partners have the same drive and dedication for excellence in everything.

Pros

- Experienced broker with over a decade of operations, large client base and has won multiple excellence awards.

- Regulated by the FCA, ASIC and FSA SVG.

- Several deposit options including e-wallets, internet banking and cryptocurrencies.

- Multiple trading tools like PsyQuation, Autochartist, Next Generation MT4, etc.

- Social trading powered by AutoTrade by MyFXbook.

Cons

- No US clients and a few other countries.

- Clients can only trade on the MT4.

- Does not have a huge range of tradable assets compared to the top brokers.

- Demo account expires after 30 days.

Regulation and Security

Axi is the trading name of AxiTrader Limited (AxiTrader), which is incorporated in St Vincent and the Grenadines. It is authorized and regulated by the Financial Services Authority of St. Vincent and the Grenadines (FSA SVG)

The Axi brand is owned by AxiCorp Financial Services Pty Ltd, a company incorporated in Australia. It is authorized and regulated by the Australian Securities and Investment Commission (ASIC). Its AFSL number is 318232.

Axi UK is a trading name of AxiCorp Limited; a company which is registered in England and Wales with the registration number: 06378544. AxiCorp is also authorised and regulated by the Financial Conduct Authority (FCA). Its reference number is 509746.

The broker strictly complies with the account segregation policy where all deposits received from traders are maintained with tier 1 banks in a special account not used by Axi for its internal operations.

UK clients will be compensated by the Financial Services Compensation Scheme (FSCS) if Axi broker becomes insolvent in the future. Traders’ compensation is capped at £85,000.

Axi is a member of the Financial Commission (FC) which is a conflict resolution body that settles disputes between brokers and clients. Traders can be granted compensations of up to €20,000 per dispute.

Axi is happy to announce that as a responsible and reputable broker, it has bought a client money insurance (CMI) policy on behalf of its clients. The policy was obtained from Lloyds London and it comes at no cost to all retail account holders who maintain an account balance of $20,000 and above. If for any reason Axi goes bankrupt, qualifying traders are entitled to compensations up to $1,000,000.

Account types and fees

Axi accounts can be maintained in up to 10 currencies; EUR, AUD, GBP, USD, CAD, CHF, HKD, JPY, NZD, and SGD. The maximum leverage is 1: 500 but there is no minimum deposit for each account. Below are the account types:

Standard accounts

The spreads start from 0.4 pips and there are no commissions.

Pro account

This account features raw spreads starting from 0.00 pips. A commission of $7 is charged for a round trip.

Islamic account

This swap free account is specially made for Muslim clients who are forbidden by their faith to receive or pay interests. To open an Islamic account, just open a normal account and then contact the support team.

Demo account

Axi provides practice accounts for the Pro and standard accounts. It comes with $50,000 worth of virtual funds already deposited in the account. A demo account expires after 30 days but if you open a real account, it can be extended indefinitely when you contact the support team.

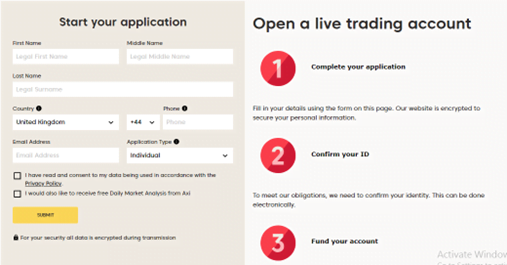

Account opening

Axi trading account can be opened within minutes, just click on the ‘open account’ button found on every page on the website. This action opens the account application form.

Complete and submit the form; you will receive an email from Axi with your customer number and a link to verify your email and set up your password. Next, choose an account type, account currency, leverage and enter your full name, date of birth, address, etc. Then, you are required to upload your government issued identity card and a utility bill. Also, answer questions about your source of funds, net worth, trading experience, etc. Agree to term and conditions and submit the form. A confirmation email will be sent to your email address; the Axi client experience team will review and approve the application within 24 hours. When approved, you can make a deposit and trading can start.

Trading instruments

On Axi’s platform, you can trade the following CFD instruments:

- Over 70 currency pairs

- About 50 stocks CFDs

- 17 index cash CFDs

- 14 index future CFDs

- 5 cryptocurrency

- 11 commodities

Axi Deposit and Withdrawal

Axi has many deposit options and does not charge deposit or withdrawal fees for funds below $50,000 per month. Third party transactions are prohibited in line with its Anti Money Laundering (AML) policy. Withdrawal requests are processed within 1-2 days. The following payment options are available:

Debit/Credit card

Card payments are accepted in multiple currencies. Deposits are processed instantly but card withdrawals are not available.

Bank wire transfers

Accepted in 10 currencies, bank wires are used freely for deposits and withdrawals; it can also be used for withdrawing funds deposited through other methods. The minimum withdrawal amount is $50 and it takes 1-3 days to completely process a transaction.

Internet banking

Internet banking payment in local currency is accepted in Brazil, china, Thailand, Vietnam, Indonesia, Poland, Hong Kong, Malaysia, Singapore, Philippines, South Africa, Nigeria, Kenya, Ghana, Cambodia, etc. Typically, deposits are instant while withdrawals take 1-3 days. The minimum withdrawal fee is $5 or its equivalence.

Online payments

FasaPay, GiroPay, iDeal, Neteller, Skrill, POLi, Sofort, Boleto and Global Collect are the options available. Most e-payments transactions are instant.

Cryptocurrencies

You can fund your Axi account with Bitcoin (BTC) or Tether (USDT). The minimum deposit is $30 equivalence while the max is $100,000 equivalent of crypto coins. The transaction time is from 0-60 minutes while the blockchain fees are borne by the trader. Clients from countries and regions like Australia, UK, EEA, Pakistan, etc are not allowed to use crypto deposits.

Axi Trading platforms

The primary platform available to Axi clients is the MT4 trading platform. This is a third party platform that is widely used by brokers and CFD traders from all over the world. Some of its features are:

- It is light, fast, rugged, versatile and scalable.

- Its interface is user friendly and can easily be customized.

- All assets’ quotes are displayed in real time; the assets’ list is customizable.

- The charts of trading instruments can be displayed in 3 styles and on 9 timeframes.

- Multiple order types which includes stop orders, trailing orders, 4 pending order types, etc.

- One-click trading is supported.

- Automated trading using expert advisors (EAs) which can be coded with MQL4 programming language.

- Access to the MetaTrader market where indicators, EAs and trading tools can be rented, bought or obtained at no cost.

Axi clients can access the WebTrader version of the MT4 via a browser or download it on a windows pc, Mac computer, android or iOS device.

Autochartist

This is a technical analysis trading tool that constantly scans the markets and alerts the trader once it finds a trading opportunity. It can be customized to conform to the trader’s preferences. Autochartist also gives volatility analysis, free market reports and detailed performance statistics. Axi clients are provided with the Autochartist as an MT4 plugin app.

Research and trading tools

PsyQuation

This is a sophisticated analytics platform powered by Artificial intelligence. It tracks the progress of a trader, scores it and compares it with that of the top traders. With PsyQuation, a trader can identify weaknesses, minimize mistakes, manage risks and build his score. It also gives customized risk alerts via app, email or sms. It comes to Axi traders at no extra costs.

AutoTrade

This is a social trading platform available to Axi clients via the MT4 platform. AutoTrade is provided by myFXbook; a popular analytics tool that enables traders to connect, compare, share, and analyze trading strategies. Through AutoTrade, traders can automatically copy the trades of other expert traders and possibly make profits without bothering about learning how to trade.

MT4 Next Generation

This is an MT4 plugin app that adds professional tools to your MT4 trading platform making it more powerful and better, especially for expert traders. Here are some of the tools that come with the MT4 next generation:

- Sentiment indicator

- Alarm manager

- Correlation trader

- Economic calendar

- Automated trade journal

- New terminal window

Money manager solution

Axi welcomes assets and money managers who trade on behalf of other clients. A powerful Multi account manager (MAM) software is provided for this purpose. From his master account, the manager can trade and manage unlimited trader accounts with speed and efficiency. He can choose from 6 allocation methods such as percent allocation, lot allocation, equity percent, etc. After setting up and customizing each account, he can initiate trade positions on multiple accounts with only one click. He can also deploy EAs and other trading tools.

Virtual Private Server (VPS) solutions

Axi has partnered with third-party VPS providers to assist its traders with reliable connections to the server. VPS is often demanded by traders who use social trading, EAs or other trading mechanisms that requires uninterrupted and quality connection to the trading servers. The partners and offers are as follows:

- ForexVPS: Axi clients that trade more than 20 lots per month get $34.99 off the monthly fee.

- MetaTrader VPS: The cost is $10 per month.

- Commercial Network Services: Plans starts at $35 per month but Axi will credit the $35 VPS fee to customer accounts that trade over 20 lots per month.

- BeeksFX VPS: Axi traders get 30% discount on the first month subscription and extra 256MB on all plans.

Education

Axi academy

Sign up for the Axi academy with your name, email and password to gain access to the academy courses and lessons. The first course in the academy introduces forex trading along with its jargons, charts, trading psychology, risk management and trading strategies. Each lesson must be completed to unlock the next one. Training progress is automatically monitored by the system. The lessons are delivered through animated videos and articles. Assessment questions come at the end of each lesson.

Axi blog

This is a frequently updated blog made up of daily market analysis, training articles, company news and other trading information. It features news and training resources on various financial markets assets.

MT4 video tutorials

There are about 9 videos teach newbies on how to install, place orders and other basic features of the MT4 trading platform.

eBooks

Axi clients are offers several eBooks that teach about forex and CFD trading. The books can be downloaded by completing a short form. They come at no cost to the trader. The books were written by experienced traders and analysts.

Webinars

You can register to attend any of Axi’s scheduled online webinars. These webinars are periodically scheduled on the website. They are anchored by Axi’s expert analysts.

Customer care

Axi has a client support desk that is available 24 hours a day; Monday to Friday. The award winning support team is friendly, willing to help and speak several languages. The ‘help centre’ has questions and answers to over 200 questions about trading, markets, MT4, trading tools and trading with Axi.

To reach out to the support team, you can send an email, initiate a web or WhatsApp chat or call on phone. There are toll free numbers for clients in Australia, China, Germany, Hong Kong, Indonesia, Malaysia, New Zealand, Singapore, Spain, Thailand and United Kingdom.

Summary

Axi is a reliable and regulated broker that really wants it clients to succeed. Apart from compliance to regulatory standards, the broker still bought an insurance policy protecting its clients’ funds.

Axi boasts of multiple funding options which include cryptocurrencies. Traders are provided with multiple tools like Autochartist, Next gen MT4 apps and PsyQuation. Newbies can create demo accounts and also access training resources from the Axi academy and blog. Investors are given opportunities through social trading and managed accounts.

But, the assets index on Axi is limited when compared to its competitors who offer thousands of trading instruments. Also, Axi has no proprietary platforms or any other third-party platform except the MT4.

In conclusion, Axi is an experienced, focused and award winning forex and CFD broker on its way to the top.

Australia - Year: 2007

Australia - Year: 2007 Japan

Japan United Kingdom

United Kingdom Russia

Russia