eToro is a financial services and brokerage firm that was founded in 2007 by brothers Yoni Assia and Ronen Assia together with David Ring. Its head office is located in Tel Aviv, Israel but it has offices in 10 locations including London, Limassol, Sydney, Gibraltar, USA, etc. eToro is popularly known for its social trading platform that enables new or unskilled traders to copy the trades of expert traders, thereby giving them a chance to make profits without even knowing how to trade. The broker boasts of a community of over 20 million clients from 140 countries.

Pros

- Strong, reputable, and well-capitalized broker with over a decade of operations.

- Prides itself on the world’s leading social trading platform with millions of traders.

- More than 2,000 assets can be traded via CFDs, real stocks, or crypto investments.

- Investors are offered CopyPortfolios at zero management fees.

- Analysis powered by Trading Central is available for high-level eToro club members.

Cons

- $5 is charged for every withdrawal.

- An inactivity fee of $10 is charged after a year of no activities.

- Traders have no other choice of the platform except eToro’s proprietary platforms.

Security and Regulation

eToro (Seychelles) Ltd. is authorized and licensed by the Financial Services Authority Seychelles (“FSAS”)

eToro (Europe) Ltd. is authorized and regulated by the Cyprus Securities Exchange Commission (CySEC) and the license number is 109/10.

eToro (UK) Ltd is a Financial Services Company authorized and regulated by the Financial Conduct Authority (FCA) with the license number FRN 583263.

eToro AUS Capital Limited is authorized and regulated by the Australian Securities and Investments Commission (ASIC). The Australian Financial Services License is 491139.

All funds received from clients are safely kept in segregated accounts maintained with the largest international banks.

Clients from the CySEC-regulated areas are protected by the Investor Compensation Funds (ICF) scheme which will pay traders up to €20,000 if eToro becomes insolvent. Similarly, UK clients are covered through the Financial Services Compensation Scheme (FSCS). If eToro goes bankrupt, account holders will be compensated up to £85,000 each.

Additionally, eToro clients from Australia, EU, and UK-regulated regions are further protected by insurance purchased by eToro from Lloyd’s of London. If in the future eToro goes bankrupt, these clients will be refunded or compensated. The payment is capped at 1 million EUR/GBP/AUD.

Trading instruments

eToro is a forex and CFD broker that offers thousands of CFD assets for trading on its platforms. Also, eToro offers 0% commissions on real stocks which enable clients to invest and own the equities of exchange-traded companies. eToro is also a cryptocurrency exchange; clients can buy, sell and keep their crypto token in their eToro crypto wallet. Below are the tradable assets available:

- 49 forex pairs

- 31 commodities

- 257 ETFs

- 13 indices

- Over 2,400 stocks from up 17 stock exchanges

- 63 cryptocurrency CFDs and 30 crypto coins

Account opening

If you wish to start trading with eToro, the first step is to sign up for a new account. Visit the website and click on ‘Join now. When the form displays; choose and enter a user name, email and password, accept the terms and click ‘create account’.

Immediately, you are logged into the eToro online trading platform. You will be prompted to complete your profile and make deposits before you can start trading. You can deposit up to $2,250 without completing your profile but the limit is removed upon profile completion and verification. Alternatively, you may also click ‘sign up with Facebook or ‘sign up with Google on the account opening form page to create a new account if you already have an account with any of the platforms.

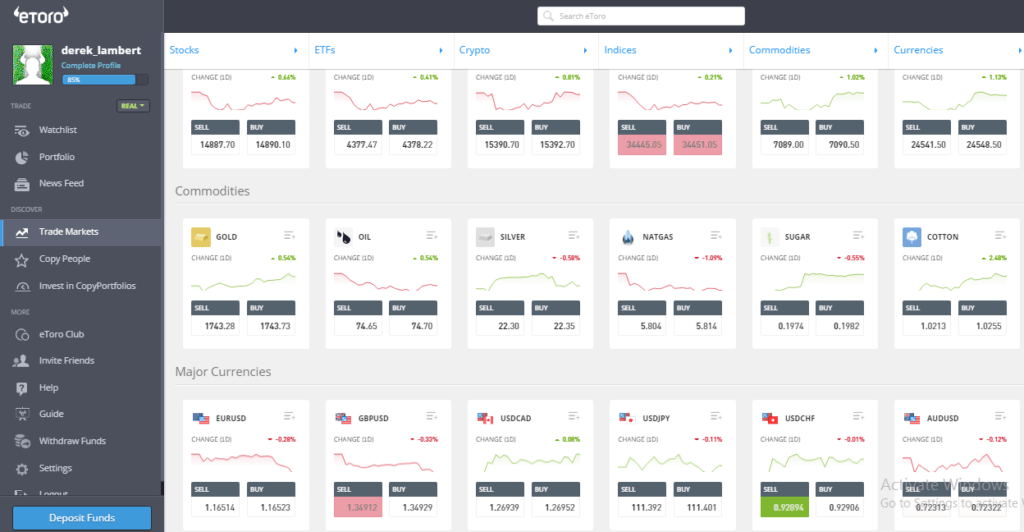

Trading platform

eToro has no third-party platforms; rather the broker offers its own trading platform which is available as an online platform and a mobile app. Below are some of its features:

- Its interface is simple, fast, and requires no complex training because it is intuitive.

- A trader can easily create a Watchlist to keep track of the prices of his favorite assets.

- You can switch between virtual and real live trading with a few clicks.

- You can follow the feed, statistics, and live chart of any asset in real-time.

- There are 5 chart styles and they can be shown on 9 timeframes.

- About 66 technical indicators and 13 drawing tools can be used to analyze charts.

- It also features the news feed, market sentiments, CopyTrader and CopyPortfolios.

Mobile trading platform

eToro has Android and iOS apps for its platform. Accounts created on the web app can be accessed from the mobile app. Almost every feature of the web platform is available on mobile apps. Clients can trade thousands of assets, access CopyTrader and carry out chart analysis. You can also make deposits, request withdrawals, and switch between live and virtual accounts via mobile apps.

Deposits and withdrawals

eToro states that deposits must be made from the same account that matches the name on the trading account. Third-party deposits are not allowed. The minimum deposit ranges from $50 to $10,000 depending on the client’s country of residence. Below are the acceptable payment options:

Bank transfers

To use this method, you must transfer at least $500. There are no limitations to transfers or withdrawals using bank transfers. The only problem here is that it is slow; it takes 4-7 days to complete.

Online payment

The online payments available depend on your residential area. They are PayPal, Skrill, Neteller, Klarna/Sofort, Trustly, POLi, WebMoney, and Rapid transfer. Typically, online payments completion time range from instant to 2 working days. Deposits are free.

Credit or Debit card payments

You can make instant deposits via popular credit or debit cards. Though deposits are fast, withdrawals using cards may take up to 8 days.

Fees and Account types

eToro offers real stock trading with zero commissions. At least, $50 is required to commence investing in stocks. For forex and CFDs, no commissions are charged because the broker’s fees are factored into the spreads. For example, the EURUSD spreads start from 1.0 pip; GBPUSD is 2 pips while GBPJPY is 3 pips. The commission for opening stocks and ETFs CFDs position is 0.09% while Crypto CFDs is 0.75%. For commodities CFDs, the spreads start from 2 pips, and indices are from 0.75 points.

When you invest in cryptos, you buy and hold them in your wallet. The commission is 0.75% for Bitcoin, 1.90% for Ethereum, and Bitcoin cash. The commission for buying Tezos (XTZ) is 5%. Transfer fees are 0.5%; the minimum is $1 while the maximum is $50.

eToro does not charge deposit fees but for every withdrawal, $5 is charged from the client’s account. If there is no login into an account for 12 months, $10 is charged monthly from the account as inactivity fees.

Unlike most brokers, eToro does not designate account types and conditions attached to the account. There can only be a retail account which is a real account available to everyone that completes the form and deposits $50 and above.

Professional accounts are available on request to traders who are experts that have professional training, a huge portfolio, and/or vast trading experience.

A demo account is automatically available to all clients and it is preloaded with $100,000 in virtual funds.

Trading accounts can be converted to a swap-free Islamic account. Just open an account, fund it with at least $1,000 and contact the support team.

Research and tools

eToro Club

eToro offers club membership to all its clients. The membership is tiered and it is dependent on the client’s realized equity. It is automatic and calculated by midnight GMT, every day. Upgrades are updated daily but downgrades are processed monthly. Below are the membership tiers according to the corresponding realized equities:

- Silver tier: $5,000

- Gold: $10,000

- Platinum: $25,000

- Platinum plus: 50,000

- Diamond: $250,000

Members enjoy lots of benefits according to the tier. For example; from Platinum and above, members enjoy no withdrawal fees, Trading Central analysis, no exchange fees, a dedicated account manager, zoom meetings, and even invitations to live events.

eToro money account

With an eToro money account, you can make free deposits, and instant withdrawals, enjoy free USD conversions, and manage your assets which include your crypto coins. Very soon, eToro club members will receive an exclusive Visa debit card which can be used to make purchases online just like any other card. You can also get a personal account number in order to send and receive money to and from any bank account. You can access the eToro money account via the eToro money app which is an android and iOS app built to manage your assets, be it in cash or crypto wallet. At the moment, this service is only available to eToro club members in the UK.

eToro investment portfolios

eToro Portfolios or CopyPortfolios are investment packages that bundle related assets into a tradable security. Most of the Portfolios are created by eToro’s team of experts after thorough research. The latest technology and risk management tools are deployed in managing every portfolio. Investors can view the Portfolios on the platform, read about them, and then make a decision to invest or not. There are no management fees but the minimum investment amount is $5,000.

CopyTrader

This is a powerful feature of the eToro trading platform and the engine of its social trading. With CopyTrader; an investor can search and find expert traders whose trades he will automatically copy and make potential profits. Professional traders can also make more money by enabling other traders to copy their trades at a fee through the ‘popular investor program’. eToro states that the average yearly profits of its most copied traders for 2020 is 83.7%.

eToro staking

This is a process where cryptocurrency owners trust to eToro to hold for them, eToro stakes the coins, makes profits, pays the owners monthly rewards or interest, and keeps a small percentage. So, eToro grows the crypto coins by investing them with minimum risks making them safe. It is available to eToro club members while cryptos like ADA, TRX, and ETH can be staked at the moment.

eToro earnings report calendar

On its website, eToro presents this fundamental analysis tool to all its clients. Clients can search and find the date on which a publicly traded company will release its next earnings report. Also, the dividend calendar is available; it shows the companies that pay dividends and when the next dividend is due.

Education

News and analysis

This section comprises articles presented by eToro analysts based on the current market moves and news. There is a weekly analysis and market insights on a wide variety of assets.

eToro academy

This academy is made up of articles and videos aimed at training beginners to advanced levels. The videos are sharp, animated, and easy to understand. It is well organized into topics, trader levels, and training delivery types such as podcasts, webinars, videos, and guides.

Generally, the academy comprises the following courses:

Investing 101: It has 6 lessons on ETFs, stock trading and investment, etc.

Trading 101: It has 14 lessons introducing a newbie to trading CFDs, the different asset classes, and risk management.

Crypto 101: It comprises 7 lessons teaching beginners what cryptos are and how to invest in cryptos through eToro.

eToro basics: There are 9 lessons on how to use eToro services. Some of the lessons teach how to use copy trading, make deposits, use virtual accounts, use watchlists, stop loss and take profit.

How to start investing quickly: The course has 3 lessons on why eToro is good for investing, copy trading, and social trading.

Customer care

The eToro help center is organized into FAQs and trending articles. This is done in order to help a prospective client to answer some basic questions before reaching out to the client support team. The FAQs comprise 11 groups; verification, community, copy trading, deposit and withdrawal, education, eToro partners, eToro money crypto wallet, trading and investing, troubleshooting, eToro money, and my account. If you still need help, you can open a support ticket and state the issue.

The trending articles sections present short articles explaining some questions and some concepts. For example; there are articles on ‘Trailing stop loss’, ‘how do I close a position?’ etc.

The live chat feature on the website is currently available to only eToro club members. eToro is on Facebook, Twitter, Instagram, YouTube, and LinkedIn. The support desk is available 24/5.

Conclusion

eToro is a leading brokerage that has many tradable securities. In over 13 years of its operations, it has expanded across the globe and is now regulated in 4 jurisdictions. Clients’ funds are safe and even if the broker fails, there are several insurance schemes to protect the investment.

eToro’s renowned CopyTrader is one of the most popular social trading technologies in the world of CFD trading. It also comes with tools for manual trading, risk management, and technical analysis.

However, the broker charges withdrawal fees and inactivity fees. Traders must use only the eToro platform which does not support plugin apps or trading robots. eToro is best for traders who are interested in social trading, crypto investment, or real stocks. Manual traders who use uncomplicated analytical methods will also find the eToro platform very satisfactory.

Cyprus - Year: 2007

Cyprus - Year: 2007 Australia

Australia Japan

Japan United Kingdom

United Kingdom Russia

Russia