ForexChief is an offshore forex and CFD broker that was founded in 2014 in Vanuatu but have offices in Singapore, Switzerland, Nigeria, Russia, India, etc. The broker affirms that its pricing is sourced from premium liquidity providers which are major market makers, banks and big investment firms. This is why ForexChief clients are able to enjoy tight spreads starting from 0.0 pips which is streamed to their trading platforms via it liquidity aggregator. So, it uses the STP/NDD technology, trade execution is fast without requotes. ForexChief does not interfere in order executions but only acts as an agent.

All client orders are placed through the MT4 and MT5 trading platforms which comes with multiple tools and support for mobile trading. Investors are also welcome as there is social trading and investment accounts. There is no limitation of trading strategies.

Pros

- Regulated by the VFSC

- Multiple account types are provided to cater for a wide variety of traders.

- It offers several payment options such as e-wallets, online payments and cryptos.

- High leverage; up to 1:1000

- For investors; social trading and managed accounts are available

Cons

- Offshore regulation which is not regarded as top-tier.

- Charges apply for the various withdrawal options available.

- There is no daily market news, analysis and trading ideas.

- Only about 60 assets are available for trading which is very small.

Regulation and Security

ForexChief is licensed as a dealer in Securities by the Vanuatu Financial Services Commission (VFSC). Its operations are also regulated by the same authority. It is a member of the Financial Markets Association (FMA); an association of professionals committed to accountability, expertise, efficiency and fairness.

ForexChief asserts that it has adopted the popular principle of segregation of clients’ funds from its own money. This system further protects the client in case the broker goes bankrupt. Even funds deposited via e-wallets and online gateways are still moved to the segregated bank accounts to avoid losses that may arise due to failure of the digital channels.

Furthermore, the broker’s website and platforms are protected digitally via ‘Secured Socket Layer’ (SSL); which encrypts all data sent to the trading servers from the client’s terminal. This prevents attack from internet fraudsters who may want to intercept clients’ data while in transmission with the aim of stealing credit card details, passwords, or sensitive documents.

Trading Instruments

ForexChief clients can trade the following instruments on the MetaTrader platforms:

- 40 Forex pairs

- 2 Metals

- 3 Commodities

- 10 Indices

- 5 crypto CFDs

Account opening

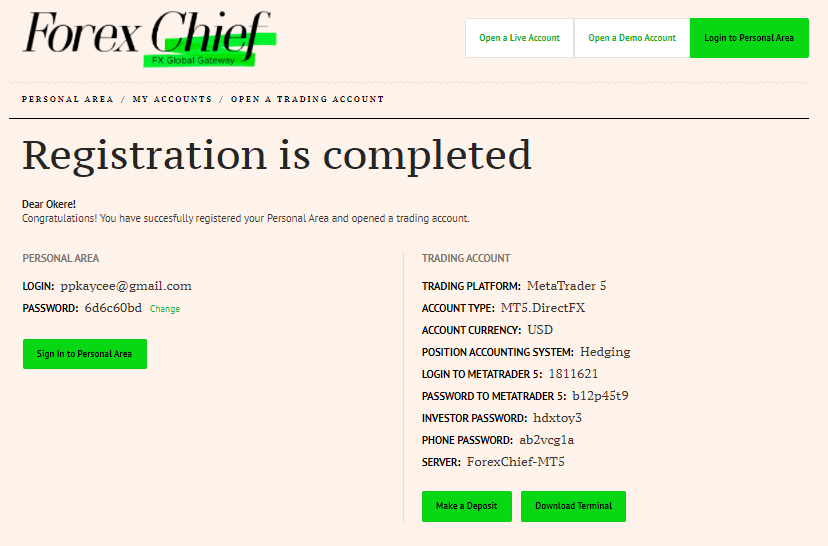

From any page on the ForexChief website, click on ‘open a live account’ at the top of the menu bar. Fill the account creation form that displays.

Next, you are prompted to confirm your email and your phone number by entering the different codes sent to your email and phone number. Then, input your platform of choice, account type, account currency, etc and click on ‘open account’. ‘Registration is complete’ message will be displayed and your personal area login as well as your MetaTrader login will be displayed. You may now sign into your personal area, make deposit, download platform and trading can start.

Fees and account types

ForexChief has multiple account types which is aimed at satisfying virtually all traders. The platform and type of account forms part of the account name; for example “Pamm-MT4.Classic+” means that it is an MT4 account for investors and managers (PAMM) and also a ‘classic’ account which pays no commissions. Cent accounts are denominated in cents; it is best for newbies who do not wish to invest much money. Only Forex and metals can be traded from a ForexChief cent account.

The minimum deposit on all accounts is $10 or equivalent in other currencies. Up to 5 account currencies are accepted: USD, GBP, EUR, CHF and JPY. The maximum leverage is 1:1000 on MT4 accounts but 1:400 on MT5 accounts. Below are the account types.

Classic accounts

These accounts are for clients who do not want to pay commissions on forex, commodities and indices but rather prefers to pay the spread charges on forex trades. The floating spreads start from 0.3 pips but the average spread on the EURUSD is 0.7 pips. Stock and Crypto CFDs are charged at 0.1% and 0.25% respectively. The Classic accounts are:

- MT4.Classic+

- Pamm-MT4.Classic+

- Cent-MT4.Classic+

- MT5.Classic+

- Cent-MT5.Classic+

Direct accounts

As the name implies, these account display direct raw spreads on the trading platforms. The spreads start from 0.0 pips. Commissions of $15 per one Million USD which is $3 per round lot are charged on forex, stocks CFD is 0.1% while crypto CFDs is 0.25%. Direct accounts are:

- MT4.DirectFX

- Pamm-MT4.DirectFX

- Cent-MT4.DirectFX

- MT5.DirectFX

- Cent-MT5.DirectFX

Islamic account

Islamic account is a swap-free account designed for only Muslims who are not allowed to receive or pay interests by reason of their faith. For this reason, ForexChief limits Islamic accounts to some countries where Islam is widely practiced. The Islamic account is only available on the standard account types which are: MT4.DirectFX, MT5.DirectFX, MT4.Classic+ and MT5.Classic+. To open an Islamic account, first create a standard account and then request for conversion to Islamic account from your personal area. ForexChief limits swap-free to about 27 selected forex pairs, Gold and Silver instruments; swap is calculated on other trading instruments.

Demo account

Clients can practice with a demo account which is available on several account types on the MT4 and MT5 platforms. During creation, you can choose the amount of virtual currency needed in the account. it is capped at $1 million virtual funds.

Deposits and Withdrawals

Bank wire transfer

International wire transfers are usually completed within 2 days. SEPA transfers are done in EUR and completed within 1-2 days. There are no commissions.

Local transfer

ForexChief accepts payments from local banks in several countries. Local transfer is available in the following countries: Indonesia, China, India, Nigeria, Thailand, Vietnam, Malaysia, South Africa, Kenya, Tanzania, Uganda, Mexico, Colombia, Brazil, Argentina, Chile and Ecuador. Deposits are processed at most within 24 hours while withdrawals are completed within 2 working days.

Debit/Credit card

The major cards as well as China UnionPay card can be used to make instant deposits into ForexChief accounts at no costs. But 2% of the transaction amount with a minimum of $5/€5 is charged per withdrawal and it takes 2-7 working days before it is completed.

Cryptocurrency payments

Crypto deposits are accepted for BTC, ETH, BCH, DOGE, USDT, USDC and DAI. Deposits are processed after 3 confirmations while withdrawals take a business day. ForexChief imposes no charges.

Electronic Payments

ForexChief accepts a lot of e-wallets and online payment options. Deposits via electronic methods are processed instantly. There are no deposit charges for Skrill, Neteller, Advanced Cash and Fasapay. WebMoney and Perfect Money are charged 0.8% and 1.99% respectively. For withdrawals, 1% is charged for Skrill and Advanced Cash; 0.5% is charged for FasaPay and Perfect Money, WebMoney is charged at 0.8% maximum of $50 while Neteller is charged at 1.9%.

Trading Platforms

MetaTrader 4

The MT4 is the most widely used forex and CFD trading platform around the world today. Traders love the MT4 because it is rugged, extendable, supports automated trading, complex charting, and social trading; in fact, its features are unlimited. The MQL4 programming code can be used to develop plugin apps that add features to the platform. Already, several MT4 apps such as trading robots or Expert Advisors (EAs) and indicators are already in use, forcing many traders to stick with the MT4. ForexChief provides the MT4 as a windows desktop application as well as android and iOS mobile apps.

MetaTrader 5

The MT5 was supposed to replace the already existing MT4, so it was built with more features than the MT4. It has exactly the same physical interface as the MT4, same chart patterns, tabs and general functions. But, the MT5 has 21 chart timeframes as against 9 found in the MT4. It has 6 pending orders while MT4 has 4; it comes with 38 technical indicators and 44 analytical tools while the MT4 has 30 indicators and 24 analytical tools. With the MQL5 programming code, plugin apps including EAs can be built for the MT5. However, MT4 and MT5 are not compatible and apps built for the MT5 does not run on the MT4. So, many brokers offer both platforms as both of them can run parallel on a system.

Just like the MT4, ForexChief provides the MT5 as a windows desktop application, iOS and android apps.

Research and tools

ForexChief mobile app

In addition to the MT4 and MT5 mobile apps, ForexChief has its own proprietary mobile app which is available for android devices. From the app, clients can create new accounts, make deposits, request for withdrawals, upload verification documents, activate bonuses and access customer support. The app is just like the clients’ personal area. It cannot be used to analyze the markets or open trade positions at the moment.

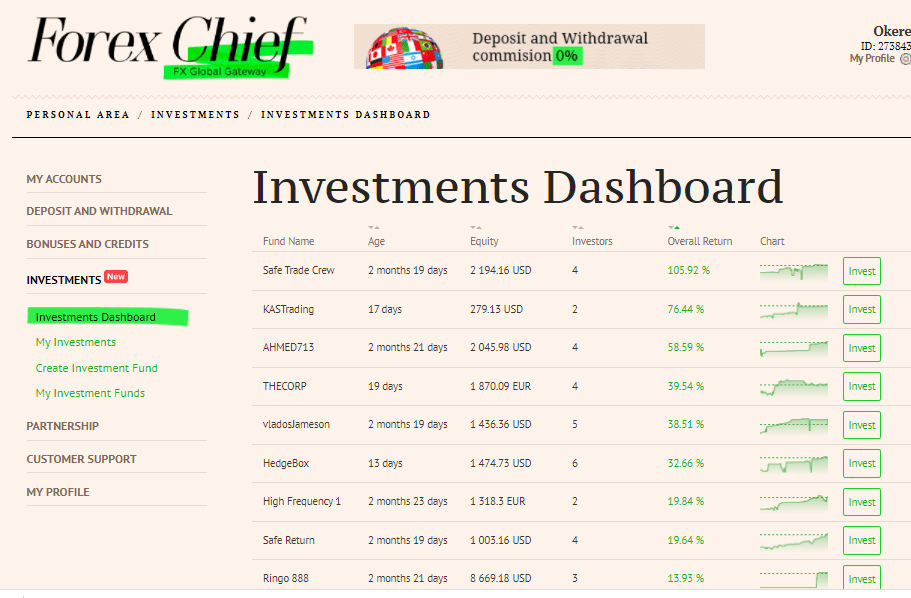

Investment fund

Account managers can create investment funds after signing up for a PAMM account, that is, PAMM-MT4.DirectFX or PAMM-MT4.Classic+ account. Then, fund it with at least $100 to activate the fund and make it visible in the rating. Investors will then invest into the fund by transferring their money into the fund and then watch the performance of the manager. Investors pay a commission to the manager only when he makes a profit.

Copy Trading

An investor may register for a standard ForexChief account and then partake in social trading via the MetaTrader platforms. After registration and making a deposit, he then browses through signal providers and make a choice by subscribing to a signal provider. Anytime the provider opens positions, his trades are automatically copied to the investors account. This gives investors a chance of making profits without learning analysis or trading.

Trader’s Calculator

ForexChief provides a forex traders’ calculator that is useful in planning trades. Just input your account type and currency, forex pair to trade, volume and click ‘calculate’. The calculator will display the contract size, pip value, spread, ‘swap short’ and ‘swap long’ values.

Bonus and Promotions

$1000 for new investment funds

This is for experienced traders who have verifiable trading history and wishes to create and manage public funds. To qualify, create a new public investment fund with 20% commission and activate it by verifying the account and making a deposit not less than $100. Then create a support ticket and attach a proof of your previous trading experience which shows how successful you were. If the proof is satisfactory, ForexChief will add $1000 from a real investor into the new fund.

Welcome Bonus

New clients who indicate interest by enrolling for welcome bonus are rewarded with 100% first deposit bonus capped at $500. It is only available to standard accounts and not cent or PAMM accounts. Welcome bonus is only enjoyed once on a first deposit of at least $50. It can be withdrawn when the trader has reached the required turnover.

No deposit bonus

This is designed for new clients to test the services of ForexChief without using their own funds, so, $50 is given to the client for trading after registration and identity verification. It is only available on MT4.DirectFX and MT4.Classic+ accounts and can be withdrawn once the required turnover is reached.

Turnover rebates

Every week, ForexChief calculates the turnover of active traders and rewards them with a form of cash back. This is automatic for every trader and requires no special application or activation. It is not available for PAMM accounts.

Trading Credits

These are the rewards received as deposit bonus. It ranges from 10% up to 50% bonus. It is only available in the MT4 accounts and cannot be withdrawn or used in a drawdown situation.

Education

Articles about economics

This section contains useful articles that teaches clients about the financial markets, investment methods, cryptocurrencies, forex, economies of nations, analysis methods, etc. Altogether, there are about 29 articles but there are no recent additions.

Library

This section is like an archive that contains some training resources. It has the following:

- History of forex: A short article describing how forex trading began.

- Trader’s first steps: This very short article advices newbies to focus on training, demo trading and having a plan before going live.

- Articles about trading: This is made up of about 18 short articles that expose the client to the best assets to trade, trading tips, cryptos, stocks, ETFs and general trading and investment advice.

- Forex trading strategies: It has 13 articles introducing traders to various trading strategies.

- Trading Indicators: This section contains a list of 23 indicators. Clicking on each indicator gives a detailed article explaining its usage and abilities.

Summary

Though a relatively new broker, ForexChief is growing its services and client base to become a global broker. Regulated by the VFSC, it has implemented clients’ fund segregation, KYC, Anti-money laundering and other standard security procedures to ensure that clients’ funds are safe and a conducive trading environment is provided.

Though ForexChief has no proprietary platform, but its choice of MetaTrader platforms is great because these platforms are accepted by millions of traders from all over the world. To accommodate most traders and strategies; there are up to 10 account types and more than 20 payment options. Also, traders are encouraged with many training articles and bonuses.

However, the bane of the brokerage is its offshore regulation which is frowned at by most expert traders and professionals. Again, only a few assets are available when compared to competing brokers that offer thousands of instruments for trading on their platforms. Though multiple education articles are provided, there is no organised academy for beginners. Also, the brokerage is lacking in the area of pro analysts that will present trading ideas and daily market outlook for traders.

Summarily, ForexChief is a broker that has been around for 7 years and still growing. It is believed that in the near future, the broker will expand its services including its asset index, in-house analysts and possibly become regulated by a tier 1 regulatory authority.

Singapore - Year: 2015

Singapore - Year: 2015 Australia

Australia Japan

Japan United Kingdom

United Kingdom Russia

Russia