IFC Markets offer good trading conditions for Forex and CFDs. If you are considering opening an account with this broker, read this IFC Markets Review to know their spread, minimum deposit, Metatrader4 and Metatrader5 platforms. A forex market is a risky place. Trading without proper research and strategies, you may end up losing your account.

IFC Markets provide brokerage service in the market as a part of IFCM Group that has been operating with financial services and technologies since 2006. They have structured their service for both beginner and professional traders. There is attractive leverage up to 1:400.In 2018, IFC Markets added Bitcoin futures to the list of its market instruments.

A wide range of tradable instruments, a dynamic proprietary trading platform, and tighter spreads are the reasons why you should choose this broker.

Another reason professional traders give them a shot is the ability to create custom pairs with different instruments from available asset classes in your portfolio. This trading technique is called the Portfolio Quoting Method.

They also have some issues that may compel you not to like their service. Lack of having 24/7 support, the complex withdrawal process with added transfer cost, and an MT4 without the floating spread are the causes you probably won’t choose them for.

IFC Markets run partnership and affiliate programs for engaging finance enthusiasts with them. If you can offer help with your trading skills you also have an opportunity to make good passive income streams.

Safety and Regulation:

IFC markets provide financial services worldwide except for the USA, Russia, and Japan. They are operated by IFCMARKETS.CORP. and regulated by the British Virgin Islands Financial Services Commission (BVI FSC). BVI FSC authorizes their financial services through a category-2 licence.

They have another entity named IFCM CYPRUS LIMITED regulated by Cyprus Securities and Exchange Commission (CySEC). They Don’t trade publicly and put the clients’ funds in segregated bank accounts. BVI FSC ensures through their supervision that the traders don’t lose their funds in case the broker goes insolvent.

The IFC Markets Cyprus entity has membership in ICF (Investor Compensation Fund). They are monitored by the Markets in Financial Instruments Directive (MiFID), a European regulation to provide authorized service in EEA Countries.

Besides, IFCMARKETS.CORP. has insurance with AIG EUROPE LIMITED and guarantees an indemnity against the risks of professional liability.

Tradable Instruments:

IFC markets have a huge range of trading instruments for trading. There are over 600 market products for trading across six different asset classes. They are one of the largest CFD providers in the market.

Besides, through their Portfolio Quoting Method, you can create a portfolio with unlimited assets. You can trade more than 400 CFDs on stock and indices. There are CFDs available on commodity futures, continuous commodities, and ETFs. Trading with CFDs will allow trading with 100% dividend. Also, they have gold instruments and 6 precious metals.

Recently, they have started offering crypto-trading via CFDs. Currently, you can trade only on bitcoin CFDs through CFD on the nearest futures.

Their proprietary platform NetTradeX has 7 synthetic derivatives for trading. These security products are technically designed to follow the cash flows of a single security. Last but not the least, IFC Markets allows you to trade 50 currency pairs with instant execution. You will have access to all the major pairs and a wide range of exotic pairs.

IFC Markets Platforms:

IFC markets have their own proprietary platform, NetTradeX. They allow the best of their trading facilities while trading via this platform. For Forex and CFD markets it allows only a single account for an individual. This platform provides good Risk management assistance that includes pending orders and trailing stops. Apart from its user-friendly interface and Technical analysis tools, it offers a revolutionary trading opportunity with its Personal Composite Instruments (PCI) technology.

It will allow you to trade with your own custom-made pairs not only with currencies but different other market instruments in your portfolio. Here, you can compose tradable pairs by selecting a base and a quote part where each part may contain more than one asset from different asset classes. The worth of the pair will be calculated from the pricing fundamentals of the involved instruments. The process of this customization of asset pairs through their market evaluation is called the Portfolio Quoting Method or GeWorko Method.

The CFD markets have mostly been dominated by the established securities and derivatives markets, and the way liquidity providers have liked to trade and hedge. So, there were only the sophisticated OTC (over-the-counter) derivative brokers who could enact such a kind of pair modification.

You can apply the PCI technology to different trading strategies that will allow you to do pair trading or spread trading. A trader can explore the market with an exceptional level of trading knowledge and opportunities on different instruments rather than the way they are traded traditionally.

MetaTrader:

IFC markets also support MT4 and MT5 platforms. Both are available on Web, Desktop, and Mobile trading platforms. The versions are compatible with Windows, MAC, Android, and iOS. MT5 is not offered for MAC Operating System.

The web version of their platform is WebTerminal. It provides all the features provided by the desktop trading platform including linked and pending orders.

There is an extension for the desktop version of MT4 called Multiterminal. Traders can enjoy Pre-installed technical indicators and signals service with strategic support.

Besides, with IFC markets MT4 you can also try Automated trading enabled via the MQL4 program language.

Where MT4 allows you to trade with fixed spread, MT5 allows you to trade with floating spreads. There are also hedging and netting options available with MT5. MT5 has improved features like Additional timeframes, pending orders, and execution types. You will get an expanded list of technical indicators to speculate the market with more valid insights.

Account Types:

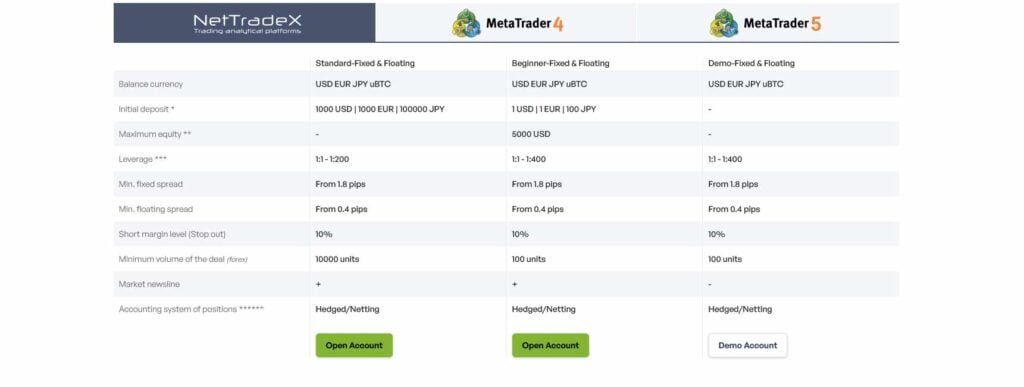

The classification of the account types is very basic. They offer two types of trading accounts for each type of platform and each of them has two types of cost plans available: fixed spread and floating spread.

The NetTradeX platform allows you to trade both on fixed and floating spreads. The account types they offer for this platform are- Standard and Basic.

Both of the accounts have a minimum margin level of 10%. The minimum floating spread starts from 0.4 pips and the minimum fixed spread starts from 1.8 pips. You can trade a minimum volume of 100 units with up to 1:400 leverage.

The maximum equity balance a basic account can hold is 5000 USD. if your balance exceeds the amount, the positions you have taken after reaching the balance will be automatically suspended. The minimum deposit for the NetTradeX basic account is 1 USD/1 EUR/ 100 JPY.

The standard account requires a minimum deposit of 1000 USD/1000 EUR/100000 JPY. The leverage available here is up to 1:200. The minimum trade volume of this account type is 10000 units. The base currencies for both accounts are USD EUR JPY BTC.

You have to choose one spread type (either fixed or variable) in case you are using any of the MetaTrader platforms. With MT4 you can trade on only fixed spreads whereas MT5 allows only floating spreads. The MT4 accounts are Standard-fixed and MIcro-fixed. The MT5 accounts are named standard-floating and Micro-floating.

MT4 and MT5 do not allow BTC as the balance currency. The minimum trade volume for a standard fixed/floating account is 1 mini lot (0.1 lot). Micro Fixed/Floating account requires a minimum volume of a micro lot (.01 lot). All other features are the same as in the NetTradeX platform.

IFC Markets also offer a Demo Account to practice trading culminating your market knowledge before you invest real money. Their Demo Account provides all the features that are mentioned in NetTradeX. You can test both the fixed and floating spread with up to 1:400 leverage with a minimum trade volume of 100 units of your balance currency but with virtual funds.

For those who want to trade in accordance with Islamic Shariah Law, can open Islamic Accounts. This account is swap free. That means it does not make any charges for holding the overnight positions.

IFC Markets Fees and Commissions:

IFC Markets charge fixed or floating spreads as per your instrument, order, and account type. They offer a competitive fixed spread starting from 1.8 pips and floating spreads from 0.4 for the currency pairs. Besides, they take swap charges for the overnight held positions.

Here are their spread and swap charges for some major Forex pairs:

| Currency | Fixed Spread (pips) | Floating Spread | Swap rates(pips) Long/Short |

| AUDCAD | 4.5 | 3.6 | -0.34 / -0.19 |

| AUDUSD | 2 | 0.5 | -0.25 / -0.18 |

| AUDCHF | 4.5 | 3.6 | -0.08 / -0.34 |

| EURAUD | 4 | 3.2 | -0.71 / -0.20 |

| EURCAD | 4.5 | 3.6 | -0.78 / -0.06 |

| EURGBP | 1.8 | 1.4 | -0.41 / -0.08 |

| EURUSD | 1.8 | 0.4 | -0.51 / -0.10 |

| GBPCAD | 6 | 4.8 | -0.57 / -0.39 |

| GBPAUD | 6 | 4.8 | -0.48 / -0.58 |

| GBPUSD | 3 | 2.4 | -0.42 / -0.37 |

| USDCAD | 3 | 0.5 | -0.42 / -0.33 |

| USDCHF | 2 | 0.6 | -0.02 / -0.52 |

| USDJPY | 1.8 | 0.5 | -0.23 / -0.42 |

IFC Markets charge .01% of the trade volume. For US stocks the charge is $0.02 per stock and for Canadian stock, it is 0.03 CAD for every opened and closed position. It is deducted from your account balance.

The minimum commission for stock CFDs is 1 unit of the quote currency except for

Chinese stocks( 8 HKD), Canadian stocks(1.5 CAD), and Japanese stocks (100 JPY).

For trading CFDs on ETFs, The commission is $0.02 per share. The minimum commission here is $1.

IFC Markets Deposit and Withdrawal:

The minimum deposit for IFC Markets Beginners account is only $1. For a standard account, the minimum deposit is $1000. You can deposit money to IFC Markets via the following payment methods:

Bank Transfer, Perfect Money, Boleto, Visa and Master Cards, Pasargad Novin, WebMoney, Bitwallet, TopChange, Bitcoin, Unistream.

Deposit through Bank Transfers usually takes 2 to 3 business days and a $30 commission from your bank account. The minimum deposit is $100 each time you pay a deposit amount in your IFC Markets trading account.

The withdrawal process is a bit complicated with IFC Markets platforms. There are charges involved as per your regions and transfer methods. The processing time for withdrawal is usually 2-3 business days. The “Operations History” page from the “My Money” section will display the withdrawal transactions from your accounts.

Education:

IFC Markets have a good domain of educational materials for providing you with detailed knowledge on forex and CFD trading. You can learn the basics from their blog and the videos available on their website. Also, they provide the fundamentals of market analysis, forecasting, and their platforms. There is an impressive collection of PDF files of tutorials books on Forex and CFDs. One of the most crucial parts of acquiring knowledge on financial markets is understanding the terminologies and jargon of the trading world. IFC Markets also have a section called Trader’s Glossary. Here you can get to know about all the basic terminologies, Annotations, and Market Languages.

They have a rich Analytics section that provides live updates on all instrument prices. Weekly analysis of the markets and features on top gainers and losers in the market. Besides the economic calendar, you will also have a Commodity Market Calendar. There is a section called “Trading Ideas” which, to some extent, has made trading much easier. You can find ready speculations based on the market trends. You just have to do a bit of your own research and put the exact order.

Customer Support:

IFC Markets’ Customer Support is quite up to the mark. You can contact their customer support even with the different social contact platforms like Messenger, WhatsApp, Viber, Skype, and Telegram. Their service can also be addressed by email, Live Chat, Call Back request, and Trading desk.

They provide their customer support in 18 languages all across the world.

IFC Markets FAQs

Do IFC Markets support internal transfer?

Yes. You can open several trading accounts and make internal transfers between them.

What is the minimum deposit amount required by IFC Markets?

It depends on the account type you are trading with. For a beginner account, it is 1USD/1EUR/100 JPY. If you are trading with a standard account the minimum deposit amount will be 1000 USD/1000 EUR/100000 JPY.

What is the leverage offered by IFC Markets?

IFC Markets provide up to 1:200 leverage for NetTradeX Standard and MT4, MT5 Standard accounts. The leverage is up to 1:400 for NetTradeX beginner and MT4, MT5 Micro accounts.

Can I include additional products to the “Market Watch” window in NetTradeX?

Yes, in case you are unable to find an instrument in the “Market Watch” window, go to the “Instruments” section from the ‘context’ menu of the window or from the “Trade”section in the main menu. Then just choose the group of instruments you are interested in from “All Instruments” in the opened window to the right. Drag the selected instruments to the left to “In Use”, your preferred list of instruments will appear on your NetTradeX “Market Watch” window.

What can I do if my NetTradeX platform does not connect to the server?

Check if you are having a connection issue. If that’s fine, contact your service representative of the Internet Service Provider (ISP) or the LAN administrator. You will find their server’s addresses by opening the Network tab from the settings menu. The tab contains the Real and Demo server’s addresses of IFC Markets. If the issue is still not solved, contact your ISP support representative.

United Kingdom - Year: 2006

United Kingdom - Year: 2006 Australia

Australia Japan

Japan Russia

Russia